?

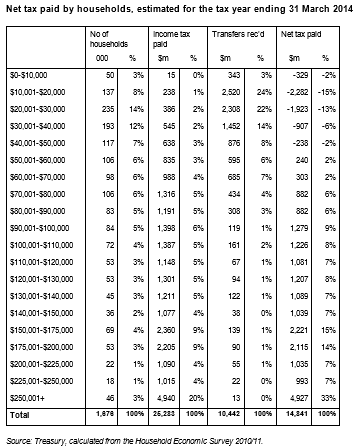

This is a fascinating table from a speech by bill English today showing how highly re-distributive the NZ tax and welfare system is. Basically what this shows is that the top 5% of households pay 47% of net tax in New Zealand. Households up to $60,000 income receive more in welfare on average than they pay in tax, Yes, they are effectively paying no tax.

Now I?m not complaining about this too much. I?m happy to some extent to help working lower income families when they have kids to look after. But when political parties complain that we need to hike taxes on rich pricks, then bear in mind that our tax and welfare system is already highly highly re-distributive. The debate should be on how we allow Kiwis to keep more of their income, not how to take more off them.

Bill English noted:

Estimates of net income tax paid by household income, before and after Budget 2010, indicate the system has become more progressive over this period, Mr English says.

Households earning less than $60,000 are generally expected to pay less, in percentage terms, towards net tax in 2013/14 than they were paying in 2008/09.?

Conversely, households earning more than $150,000 are generally paying more of the net tax than they were in 2008/09. ??

?It?s appropriate to maintain a tax and income support system that helps low and middle income households when they most need it.

?But people who call for even greater transfers to low income families, or who call for the top tax rate to be raised, need to be aware of how redistributive the tax and income support system really is,? Mr English says.

Income tax rates should be lowered, not increased.

Tags: net tax, tax, welfareSource: http://www.kiwiblog.co.nz/2013/07/net_tax_in_nz.html

jason varitek andrew breitbart dead sheriff joe arpaio limbaugh aaron smith wilt chamberlain joe arpaio

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.